reit tax advantages canada

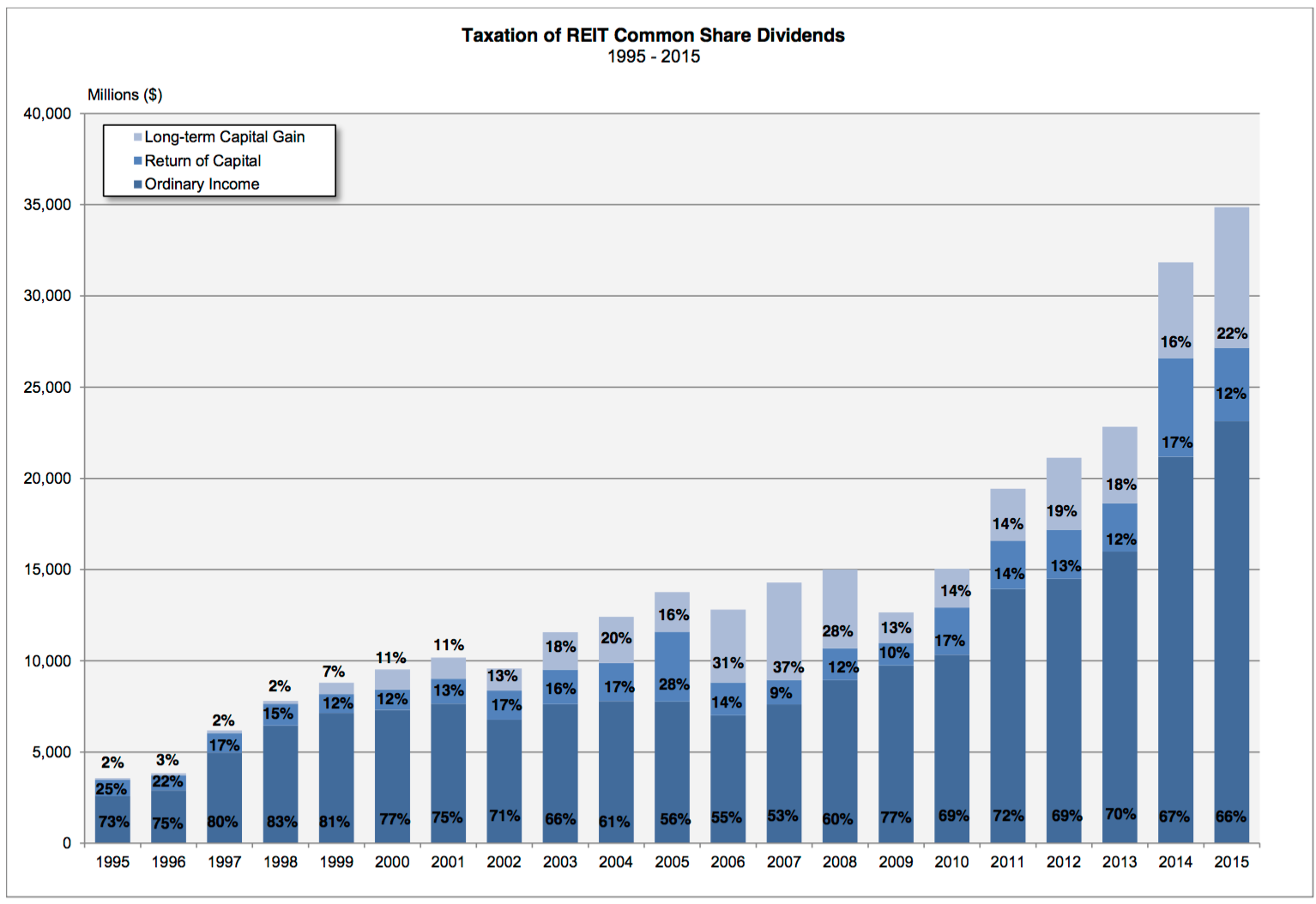

As ordinary income a majority of REIT dividends return to 396. A REITs can be very profitable as well as a growth enterpriseA high-yield dividend starts in the range of 25 for the top 20 Canadian.

Ci First Asset Reit Rit The Active Reit Etf That S Beating The Benchmark Cut The Crap Investing

Starting in tax year 2018 an additional benefit has been added to REITs thanks to tax reform.

. When reinvested the rate rises to 42. REIT Tax Benefits No. Ad Learn the basics of REITs before you invest any of your 500K retirement savings.

Get your free copy of The Definitive Guide to Retirement Income. Ad Our Knowledge Experience and Capabilities Make Us the Leader in Serving REITs. Are Reits Good Investments Canada.

The REIT collects rental income pays its expenses and then distributes almost all its remaining incomeusually 85 to 95to unit holders. Investors seeking tax benefits REITs offer three major tax benefits. Buying REIT units is similar to.

Benefits and risks. Income trust tax exemption just one advantage of investing in REITs Canada REITs can add to your portfolio in a number of other ways. Buy real estate investment trusts REITs.

Here are the benefits. How is the REITs market evolving in Canada. On the subject of REIT taxation an article in the Financial Post states.

Sit back and collect rent. In anticipation of the new tax many income trusts converted to. It owns and operates a portfolio of healthcare real estate infrastructure such as medical office buildings.

We Advise More REITs than Any Other Professional Services Firm. They do this to avoid paying tax. Wachovia Hybrid and Preferred Securities WHPPSM Indicies.

Real estate trusts are a different animal from typical corporations. REITs are much lower risk with a proven history of outperforming direct real estate investing. REIT Tax Benefits No.

The clear advantage of a REIT is to reduce corporate and personal taxes on income paid to investors 1. The effect of the new tax is to treat these entities like corporations and eliminate their tax advantage. The clear advantage of a REIT is to reduce.

We Advise More REITs than Any Other Professional Services Firm. REIT is governed by and established pursuant to a declaration of trust. REITs also help investors diversify their income streams.

Theres a better way to invest in real estate. Reit tax advantages canada. In 2026 the rate will increase to 66 but there will be a separate 31.

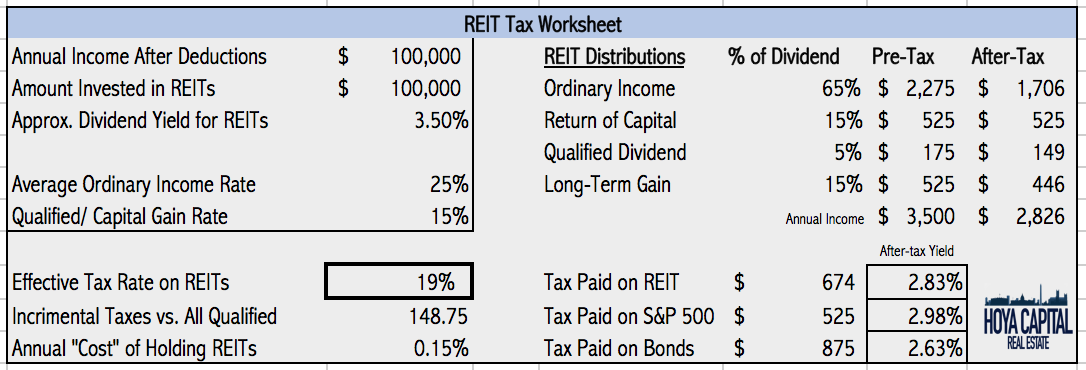

In Canada a REIT is not taxed on income and gains from its property rental. REITs are trusts that passively hold interests in real property. REIT Taxation in Canada Income Tax Treatment on Investment AccountsIncome tax on REITs is actually pretty simple to understand however the tracking of the details year.

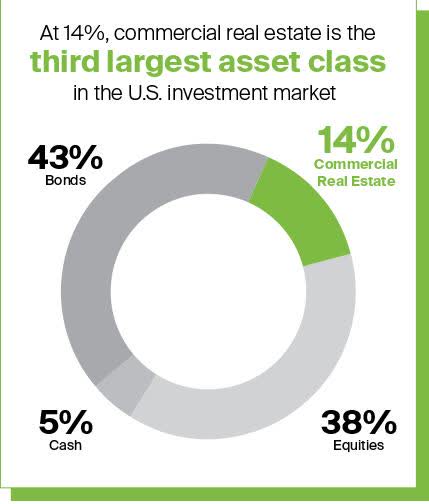

Real estate investment trust REIT A trust is a REIT for a tax year if it is resident in Canada throughout the year and meets a number of other conditions. In principle REITs like the business income and royalty trusts of yesteryear improve capital market efficiency in this sense. Investors invest in REITs mainly for higher income and for long-term growth.

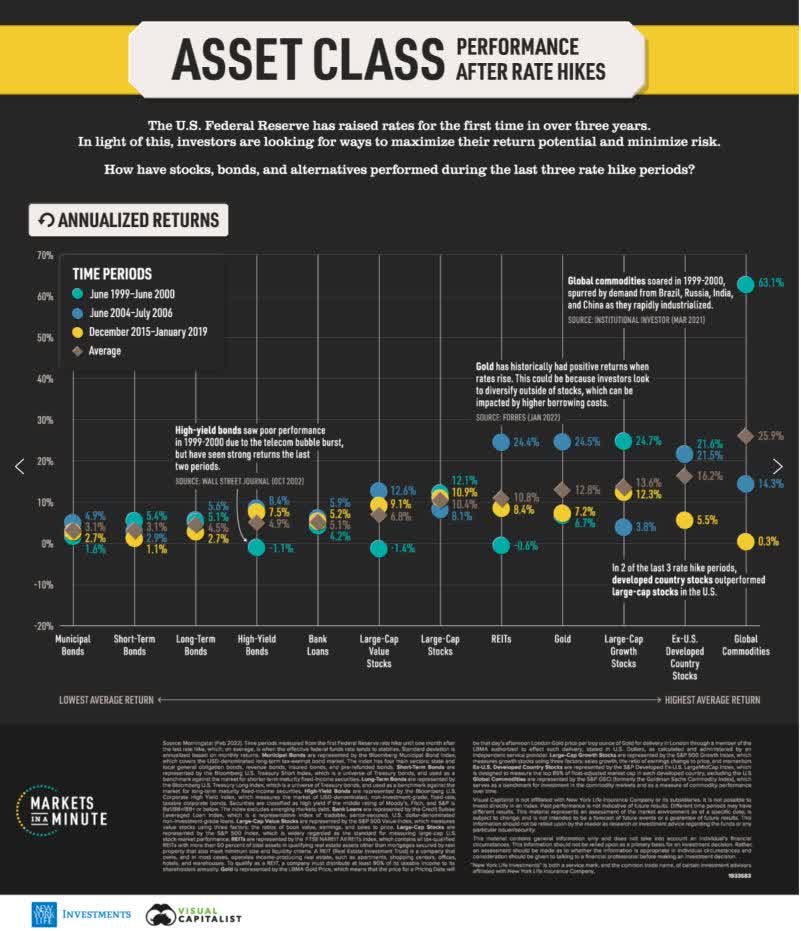

From 1977 to 2010 REITs have returned more than 12 annually. They can provide a hedge against. Trustees of the REIT hold legal title to and manage the trust.

1 pre-tax income flows through to investors 2 investors get favourable tax treatment on the income and 3 a com. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. So it makes sense that their accounting practices.

The 542 of my dividends that are qualified REIT dividends will now be 20. Ad Our Knowledge Experience and Capabilities Make Us the Leader in Serving REITs. Learn What We Can Do.

Depreciation and Return of Capital. Since their introduction to Canada REITs have become an attractive onshore tax-efficient vehicle for. The 542 of my dividends that are qualified.

In many countries REITs enjoy certain tax advantages for instance in Canada they arent taxed on gains from property and rental incomes as long as they meet certain. REITs offer certain tax advantages to encourage this investment. The 293 billion REIT is the lone real estate stock in the cure sector.

Real estate investment trust REIT A trust is a REIT for a tax year if it is resident in Canada throughout the year and meets a number of other conditions including all of the following. Learn What We Can Do.

3 Best Reits To Fight Inflation In 2022 Seeking Alpha

Can Reits Replace Investment Properties Financially Yours

2 Reits For A Well Rounded Return Potential

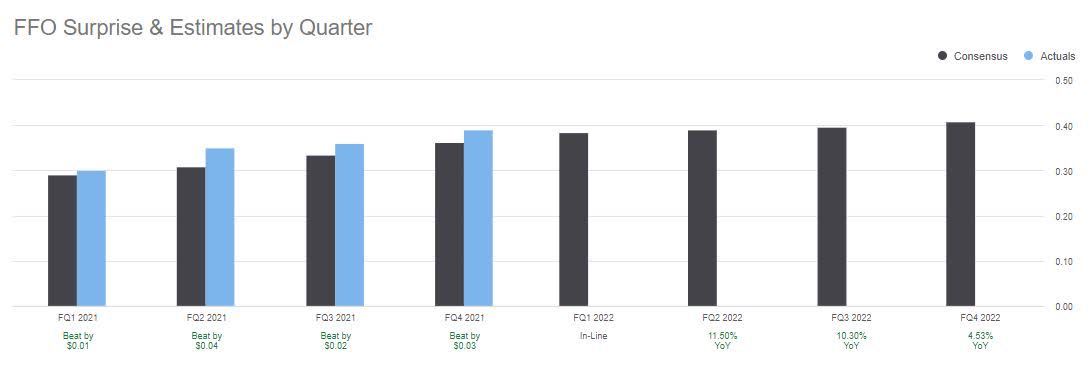

The Taxman Cometh A Look At The Tax Efficiency Of Reits Nysearca Vnq Seeking Alpha

Tax Tips For Real Estate Investment Trusts Turbotax Tax Tips Videos

Ex 1 2 A2223323zex 1 Htm Ex 1 Quicklinks Click Here To Rapidly Navigate Through This Document Exhibit 1 Logo Granite Real Estate Investment Trust Annual Information Form March 4 2015 Table Of Contents Page General Matters 1

Are Reits A Good Investment Wealth Professional

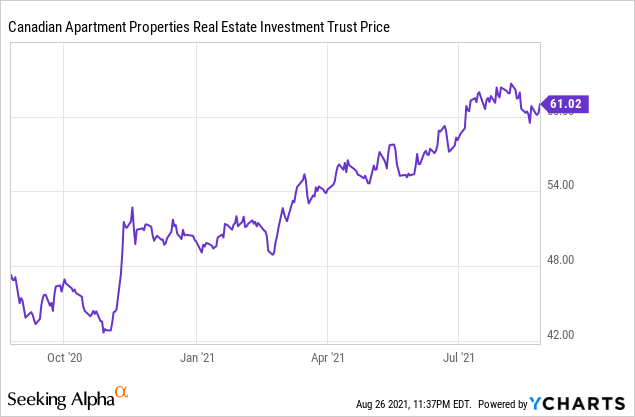

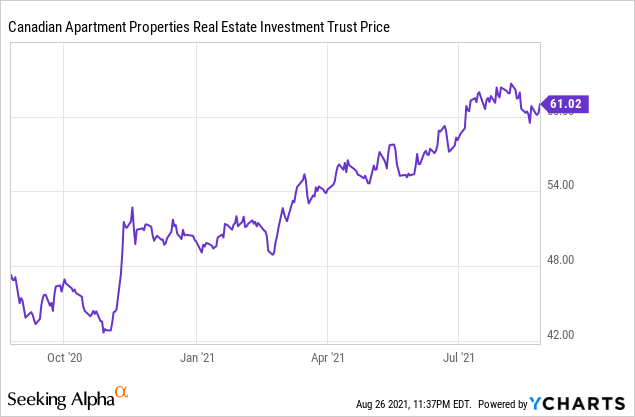

Canadian Apartment Reit Time To Take Profits After A 50 Price Increase Otcmkts Cdpyf Seeking Alpha

Canadian Net Reit And Northwest Healthcare Buying These Reits Seeking Alpha

Reits Vs Real Estate Mutual Funds What S The Difference

Real Estate Investment Trusts Reits Definition Types Pros Cons

3 Best Reits To Fight Inflation In 2022 Seeking Alpha

This Reit Is 1 Remarkable Dividend Stock The Motley Fool

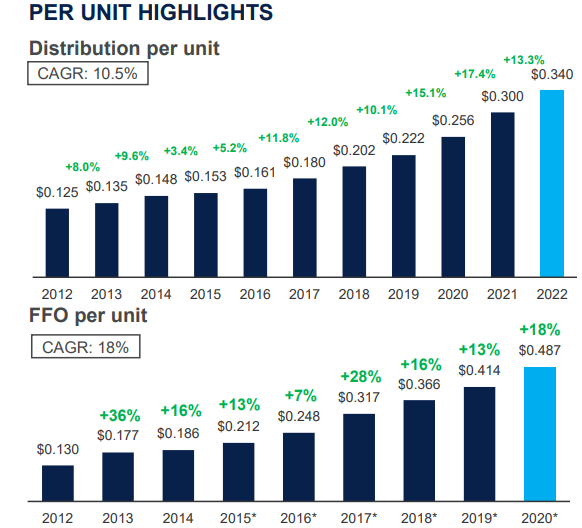

Granite The Best Performing Reit Nyse Grp U Seeking Alpha

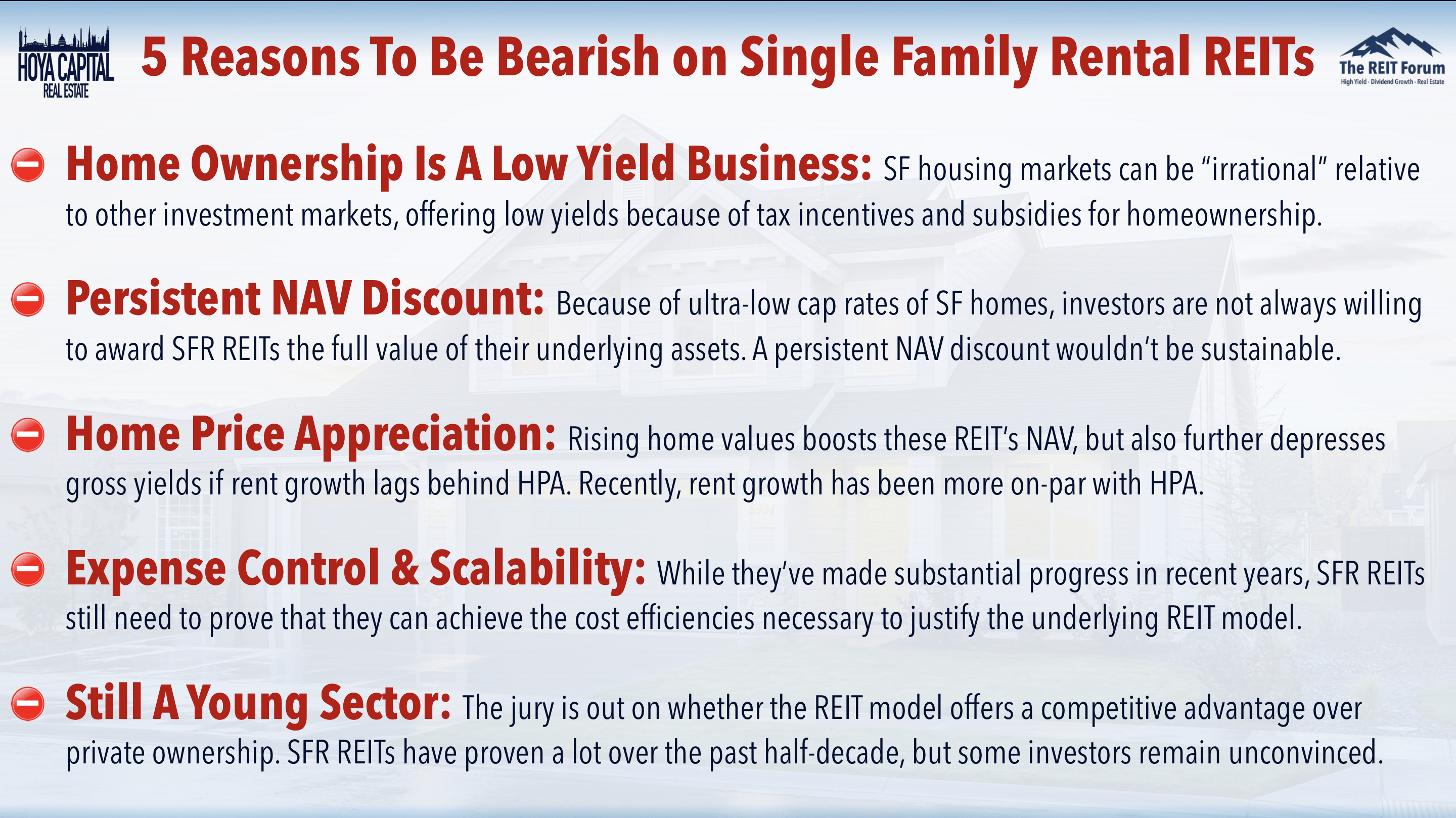

Single Family Rental Reits The Burbs Are Hot Seeking Alpha

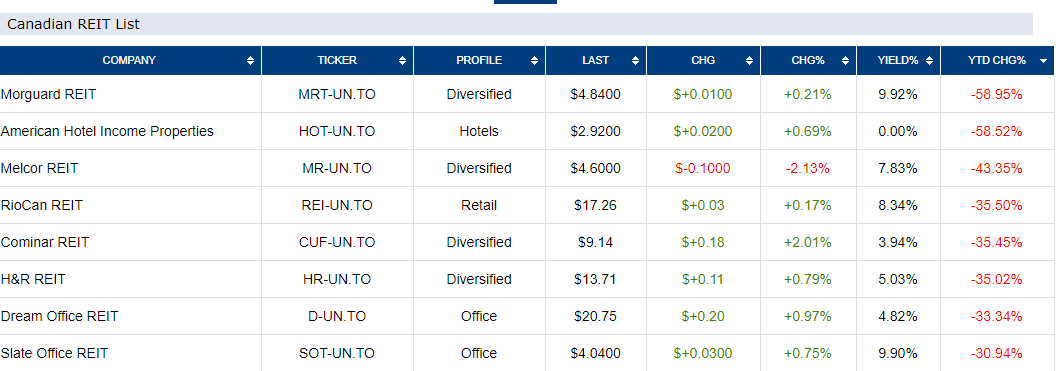

Get A 4 Yield From H R Reit Investment Trust

3 Best Reits To Fight Inflation In 2022 Seeking Alpha

The Taxman Cometh A Look At The Tax Efficiency Of Reits Nysearca Vnq Seeking Alpha